The EIR Methodology

There are times in the market when Value as a style of investing is more profitable than Growth. Conversely, there are times when Growth equities are more profitable than Value. The same applies to Capitalization size.

EIR is a strategic equity allocation methodology that was developed seeking to produce higher domestic equity portfolio returns and reduce portfolio volatility, while maintaining a fully invested equity portfolio.

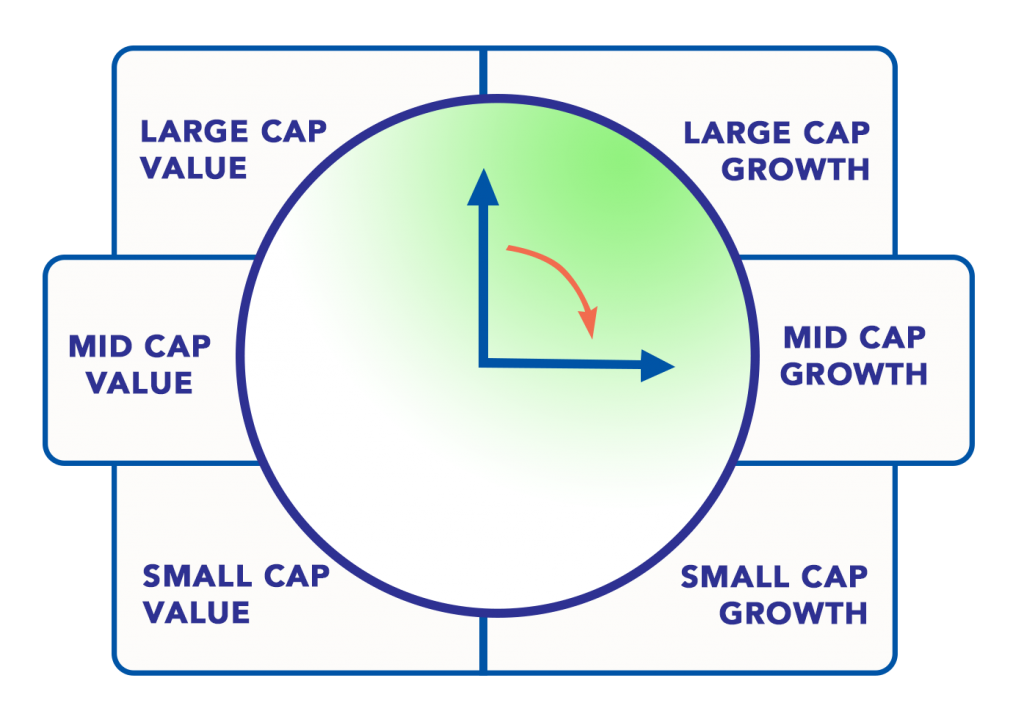

Our Enhanced domestic equity allocation process employs a methodology that seeks to identify the current dominant equity style and cap size, as well as the out-of-favor (less productive) style and cap size. Based upon this identification, portfolios are strategically tilted to the most productive asset class, while the out-of-favor style and cap size asset class is de-emphasized.

Equity portfolios are expected to be fully invested at all times. This is not a tactical market timing program.

The Equity Rotation Concept

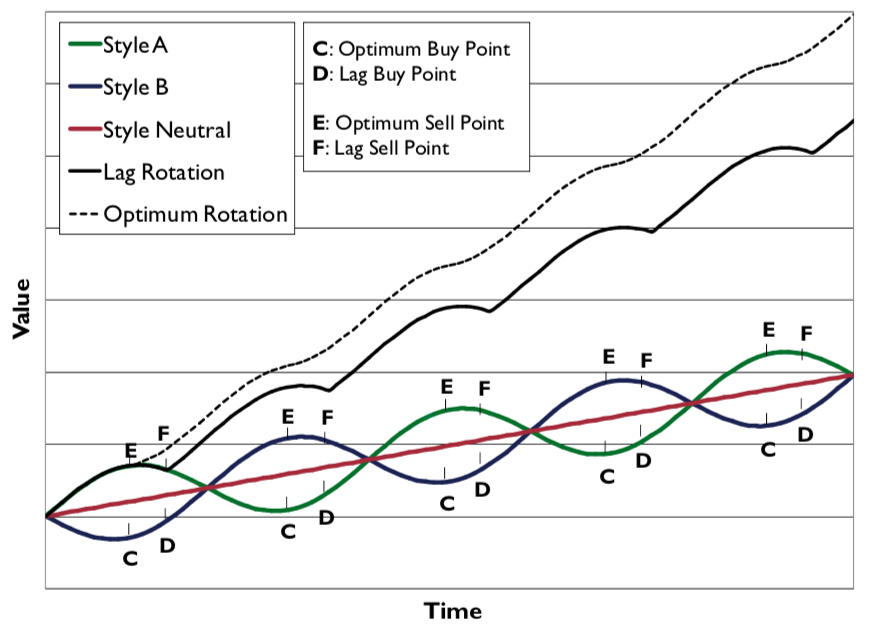

Equity rotation is achievable and successful on a trend-following basis.

EIR identifies the growth-to-value and large cap-to-small cap trends in the equity marketplace…

…and indicates when it is time to shift assets away from the underperforming style or cap size…

…and into the emerging outperforming style or cap size.

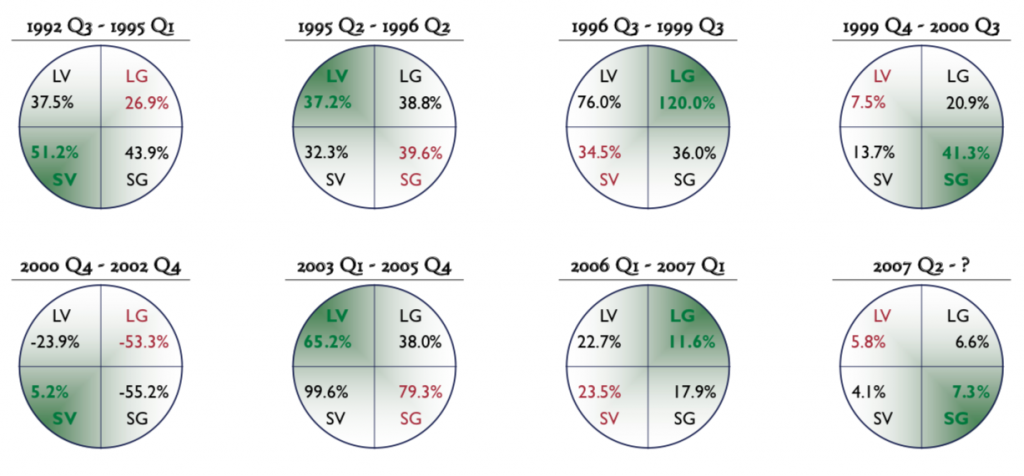

Historical Index Returns

The eight most recent periods of style and capitalization size dominance demonstrate a general trend of outperforming (green) and underperforming (red) quadrants.

Notes: data from www.Wilshire.com; cumulative gross period returns; LG = Wilshire LG Index; LV = Wilshire LV Index, SG = Wilshire SG Index, SV = Wilshire SV Index; returns do not represent actual investments

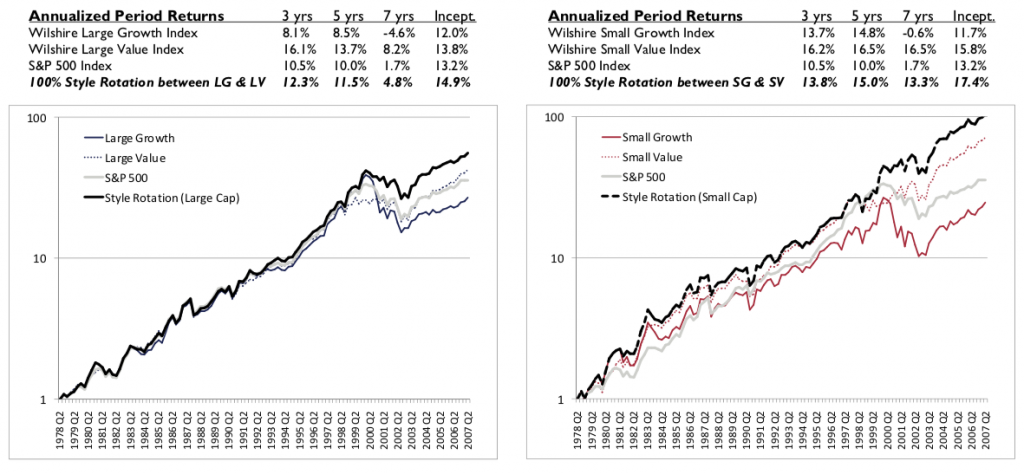

Style Rotation

Style Rotation alpha can be captured in both large cap and small cap portfolios.

Notes: data from www.Wilshire.com; annualized gross period returns; returns do not represent actual investments

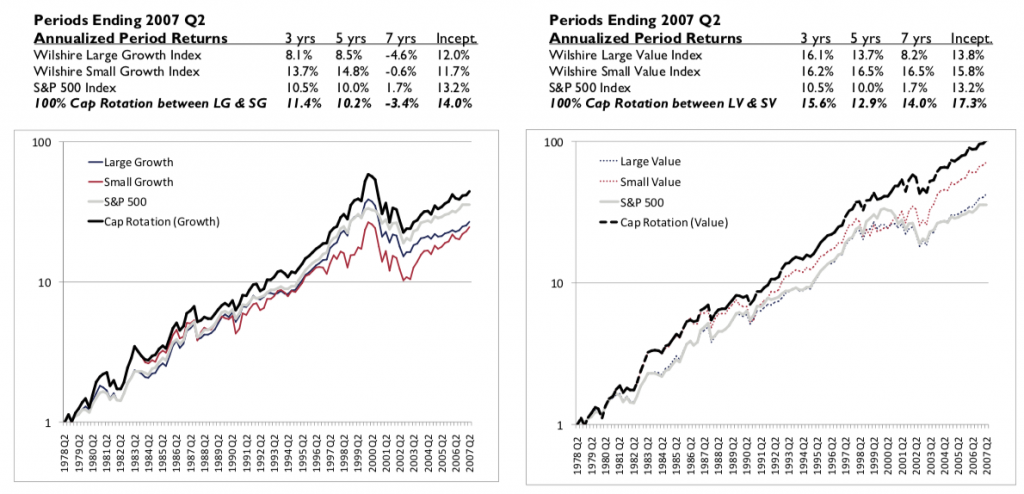

Capitalization Size Rotation

Cap Rotation alpha can be captured in both growth and value portfolios.

Notes: data from www.Wilshire.com; annualized gross period returns; returns do not represent actual investments.

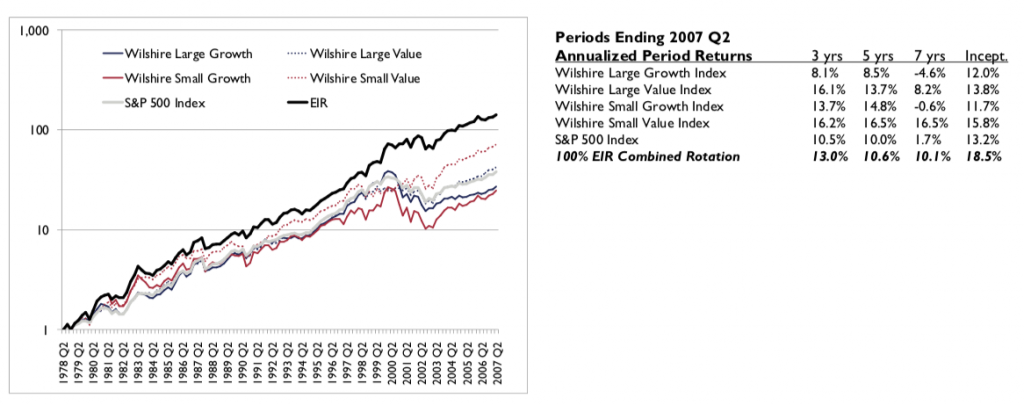

FULL EQUITY ROTATION

Style Rotation and Capitalization Size Rotation can be combined in a diversified domestic equity portfolio to produce Combined Rotation.

Notes: data from www.Wilshire.com; annualized gross period returns; returns do not represent actual investments.

The EIR Methodology

Observations and Conclusions

A growth or value equity investment style has been favored (more profitable) within certain periods of a market cycle, versus the opposing equity style, and has lasted for extended periods.

Investment style dominance has typically prevailed across all capitalization sizes: Large Cap, Mid Cap and Small Cap.

Equity cap size cycles have, at times, rewarded the utilization of investment methodologies in a manner similar to equity style rotation.

The combined results of equity style rotation and equity cap size rotation, when applied strategically (not tactically), may increase a portfolio’s overall equity returns, with equal or lower volatility than the market, over a full market cycle.

The EIR investment process can typically be incorporated within an investment portfolio, with minimal dislocation of current portfolio managers and structure, and without significant additional expense.

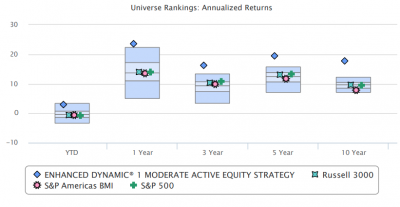

eVestment US All Cap Core Equity